wisconsin auto lease sales tax

Lease Payment Before Taxes x 1 State Sales Tax The 1 represents 100 percent of the payment. This would be the payment with sales taxes included meaning that 4413 per month was sales tax for this particular payment.

Car Sales Tax In Wisconsin Getjerry Com

Call DOR at 608 266-2776 with any sales tax exemption questions.

. 1 800 452-3328 Wisconsin residents only or 608 264-7969. You will have to pay insurance premiums. If you end the lease early you may have to pay substantial early termination charges.

The math would be the following. States except New Hampshire Alaska and Oregon and Canada impose a sales tax often called a use tax on motor vehicle purchases by consumers. 60000 x05 3000.

To learn more see a full list of taxable and tax-exempt items in Wisconsin. Some states do not impose tax on leases or rentals of equipment if the equipment is provided with an operator. Wisconsin WI Sales Tax Rates by City The state sales tax rate in Wisconsin is 5000.

Quality Durability Backed by Our 10 Year100000 Mile Limited Powertrain Warranty. 55167 x 108 59580. Wisconsin has a sales and use tax exemption for the sale of a motor vehicle to a nonresident that purchases the motor vehicle in Wisconsin and who will not use the motor vehicle other than to remove it from Wisconsin.

You may be penalized for fraudulent entries. International registration plan IRP or International fuel tax agreement IFTA Wisconsin Department of Transportation. This means that your sales tax is 3000 on a 60000 purchase price.

The Wisconsin Department of Revenue DOR reviews all tax exemptions. Any taxes paid are submitted to DOR. 2011-12 This exemption also applies to onepayment leases described above.

Ad Transform Your Driving Experience. What You Need to Know. Sales Taxes and Leasing.

And sales tax on the monthly payments. In the case of leasing the lease finance company passes the sales tax along to you the lessee even though the lease company is the actual owner of the vehicle. WisDOT collects sales tax due on a vehicle purchase on behalf of DOR.

Compare Models View Local Offers Find a Dealer. For example lets say that you want to purchase a new car for 60000 you would use the following formula to calculate the sales tax. In these cases the state considers the charge to be for a service and not for the lease or rental of property.

You can calculate the sales tax in Wisconsin by multiplying the final purchase price by 05. This page describes the taxability of leases and rentals in Wisconsin including motor vehicles and tangible media property. With local taxes the total sales tax rate is between 5000 and 5500.

While Wisconsins sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. An interesting twist on the taxability of rentals and leases can arise with equipment that is provided with an operator.

What Transactions Are Subject To The Sales Tax In Wisconsin

Nj Car Sales Tax Everything You Need To Know

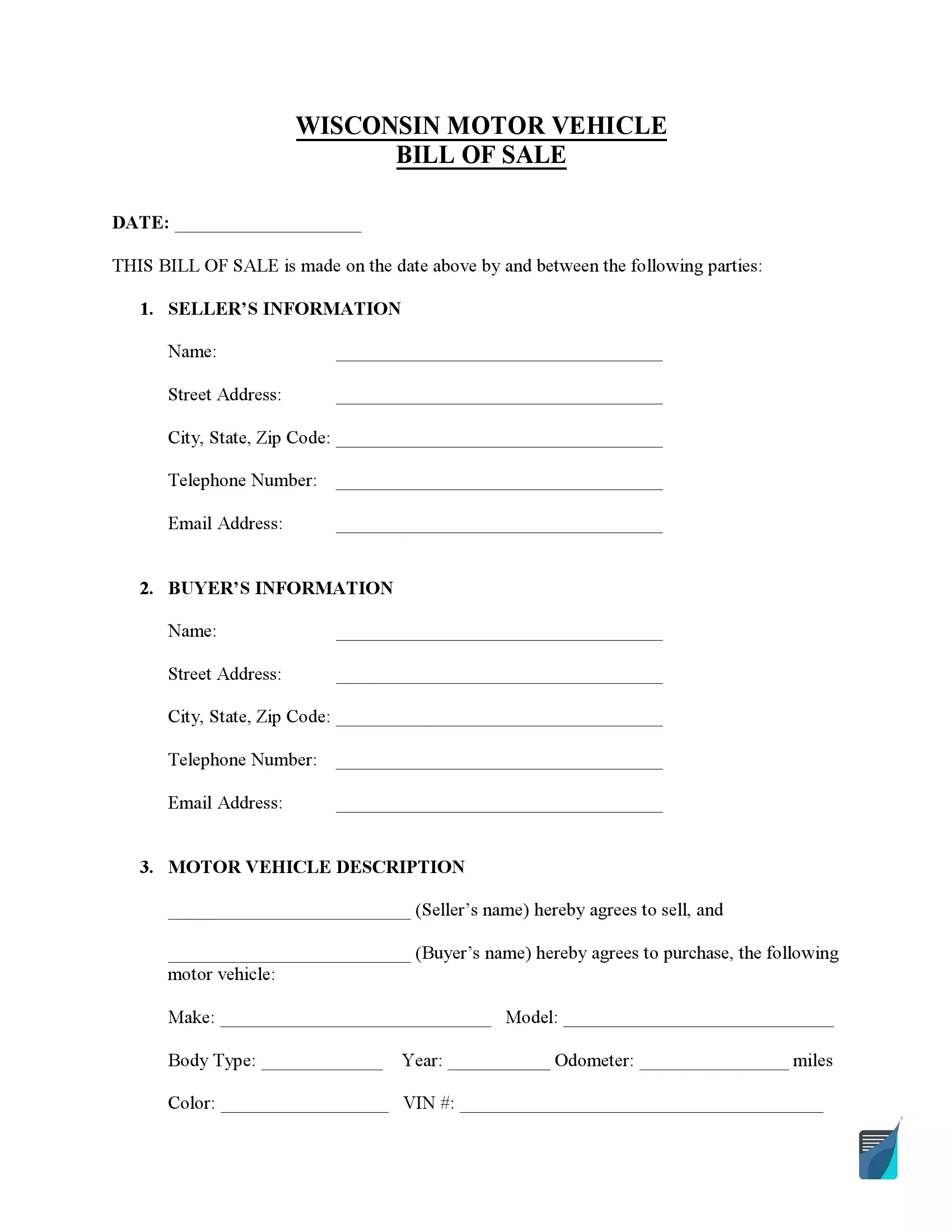

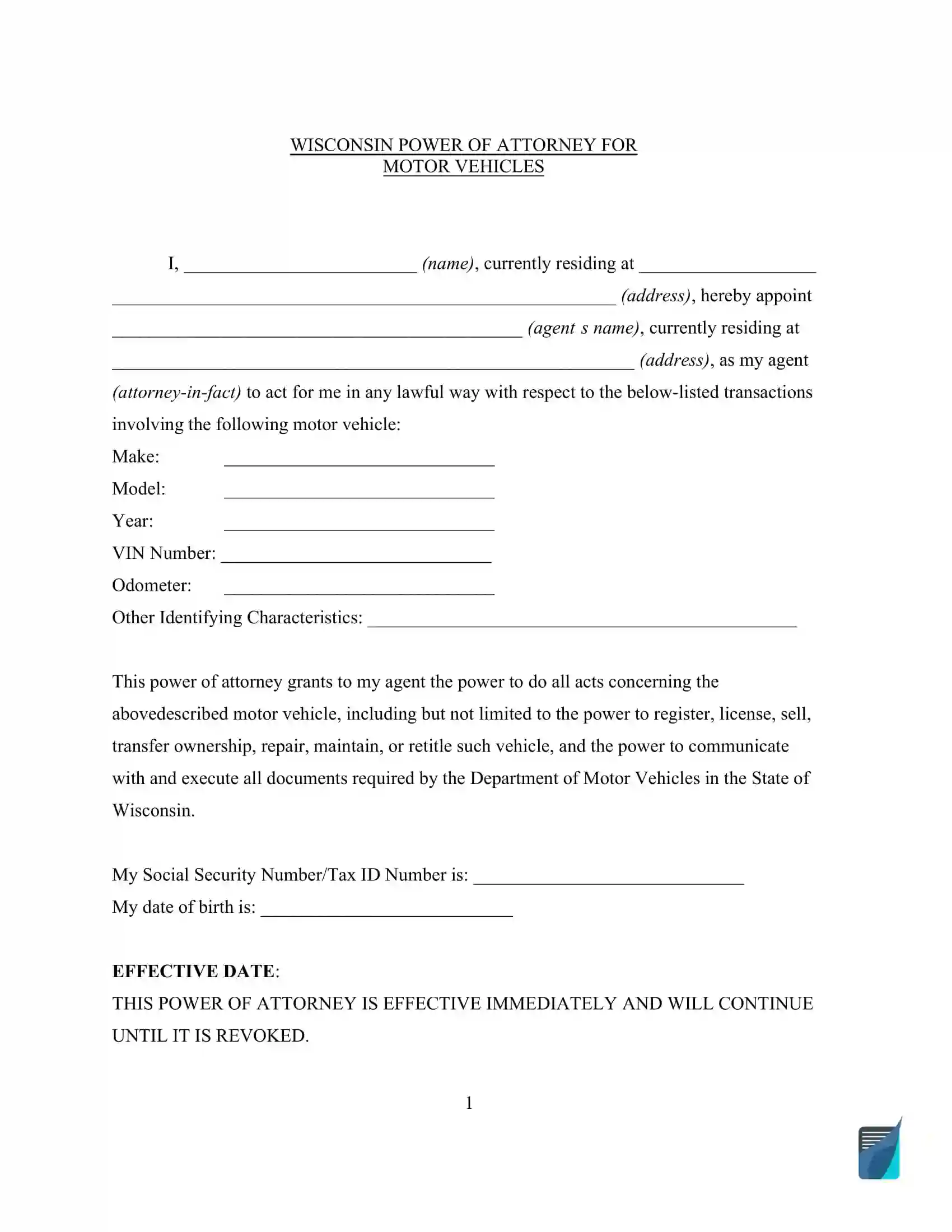

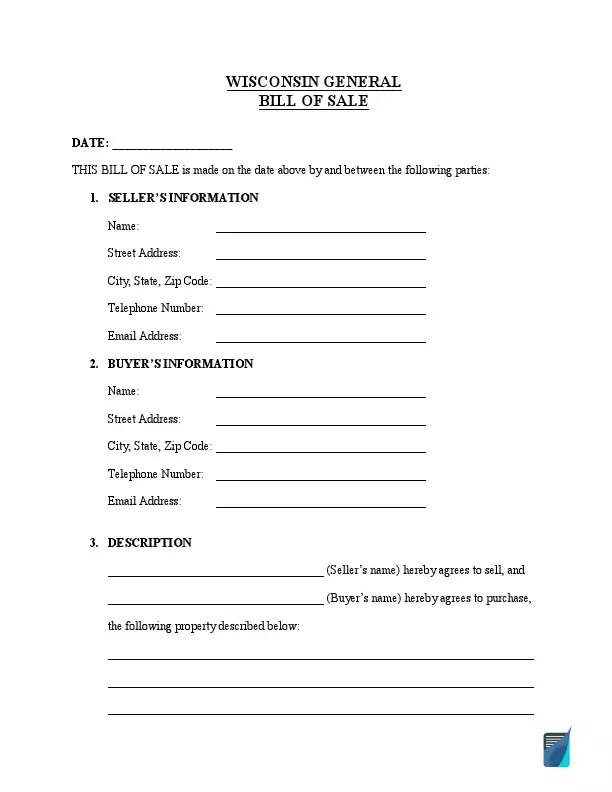

Free Wisconsin Bill Of Sale Forms Formspal

Free Wisconsin Bill Of Sale Forms Formspal

Dmv Fees By State Usa Manual Car Registration Calculator

Car Sales Tax In Wisconsin Getjerry Com

Car Sales Tax In Wisconsin Getjerry Com

How Much Does A Vehicle Title Cost In Wisconsin Title And Registration Fees

Gross Capitalized Cost Lease Calc Worksheet 9 13 Rev

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars